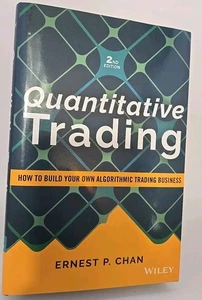

Quantitative Trading: How to Build Your Own Algorithmic Trading Busi - VERY GOOD

US $29.99US $29.99

Oct 09, 01:39Oct 09, 01:39

Picture 1 of 9

Gallery

Picture 1 of 9

Have one to sell?

Quantitative Trading: How to Build Your Own Algorithmic Trading Busi - VERY GOOD

US $29.99

ApproximatelyRM 126.38

Condition:

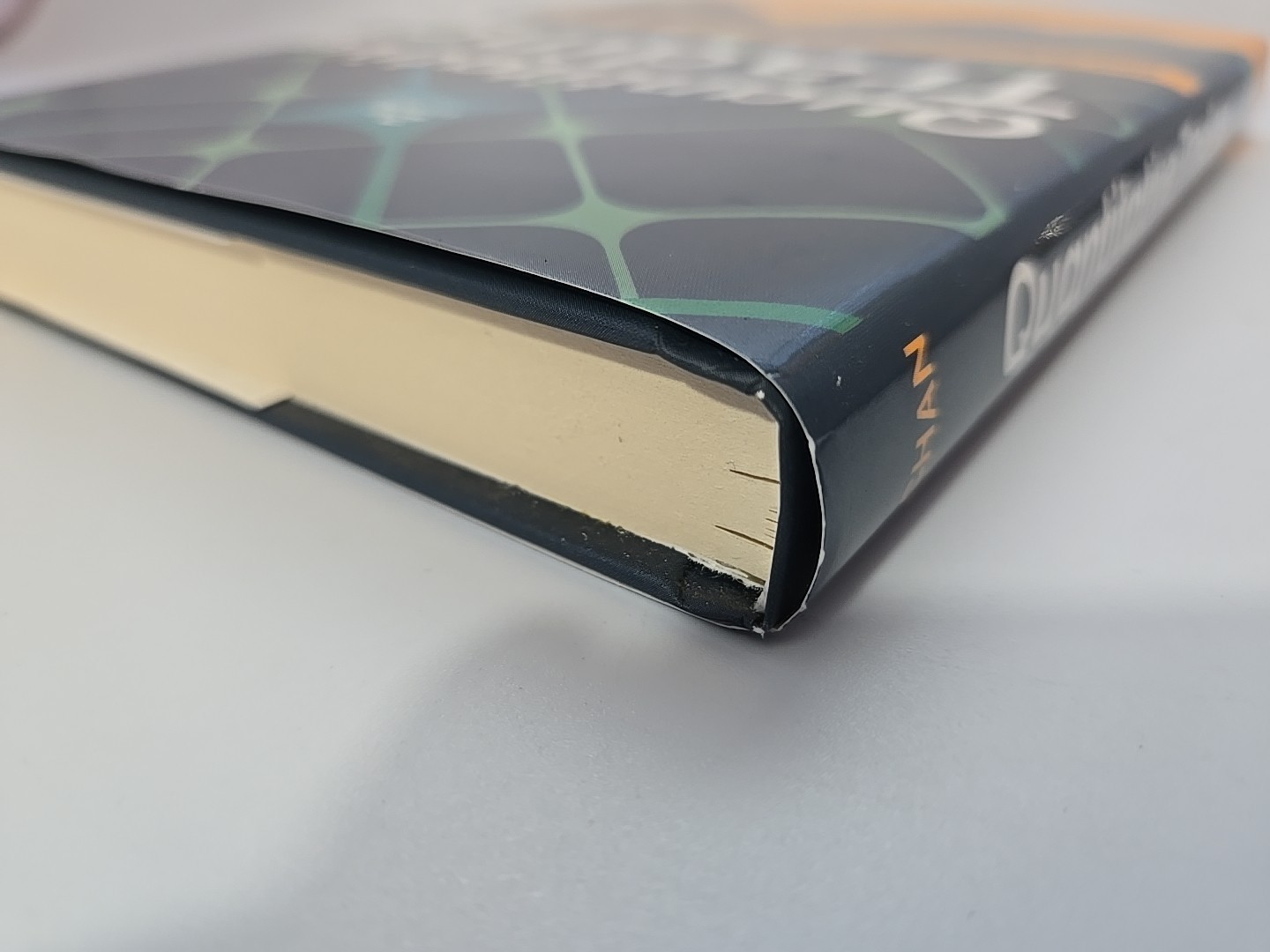

Very Good

A book that has been read but is in excellent condition. No obvious damage to the cover, with the dust jacket included for hard covers. No missing or damaged pages, no creases or tears, and no underlining/highlighting of text or writing in the margins. May be very minimal identifying marks on the inside cover. Very minimal wear and tear.

Oops! Looks like we're having trouble connecting to our server.

Refresh your browser window to try again.

Shipping:

Free USPS Ground Advantage®.

Located in: Santa Rosa, California, United States

Delivery:

Estimated between Fri, 10 Oct and Sat, 11 Oct to 94104

Returns:

14 days return. Buyer pays for return shipping. If you use an eBay shipping label, it will be deducted from your refund amount.

Coverage:

Read item description or contact seller for details. See all detailsSee all details on coverage

(Not eligible for eBay purchase protection programmes)

Seller assumes all responsibility for this listing.

eBay item number:406246567007

Item specifics

- Condition

- Brand

- Unbranded

- MPN

- Does not apply

- ISBN

- 9781119800064

About this product

Product Identifiers

Publisher

Wiley & Sons, Incorporated, John

ISBN-10

1119800064

ISBN-13

9781119800064

eBay Product ID (ePID)

2321425967

Product Key Features

Edition

2

Book Title

Quantitative Trading : How to Build Your Own Algorithmic Trading Business

Number of Pages

256 Pages

Language

English

Topic

Finance / General

Publication Year

2021

Genre

Business & Economics

Book Series

Wiley Trading Ser.

Format

Hardcover

Dimensions

Item Height

1.1 in

Item Weight

13.6 Oz

Item Length

9.1 in

Item Width

6.3 in

Additional Product Features

Intended Audience

Trade

Dewey Edition

23

Dewey Decimal

332.64

Table Of Content

Preface to the 2nd Edition xi Preface xv Acknowledgments xxi Chapter 1: The Whats, Whos, and Whys of Quantitative Trading 1 Who Can Become a Quantitative Trader? 2 The Business Case for Quantitative Trading 4 Scalability 5 Demand on Time 5 The Nonnecessity of Marketing 7 The Way Forward 8 Chapter 2: Fishing for Ideas 11 How to Identify a Strategy that Suits You 14 Your Working Hours 14 Your Programming Skills 15 Your Trading Capital 15 Your Goal 19 A Taste for Plausible Strategies and Their Pitfalls 20 How Does It Compare with a Benchmark, and How Consistent Are Its Returns? 20 How Deep and Long Is the Drawdown? 23 How Will Transaction Costs Affect the Strategy? 24 Does the Data Suffer from Survivorship Bias? 26 How Did the Performance of the Strategy Change over the Years? 27 Does the Strategy Suffer from Data-Snooping Bias? 28 Does the Strategy "Fly under the Radar" of Institutional Money Managers? 30 Summary 30 References 31 Chapter 3: Backtesting 33 Common Backtesting Platforms 34 Excel 34 MATLAB 34 Python 36 R 38 QuantConnect 40 Blueshift 40 Finding and Using Historical Databases 40 Are the Data Split and Dividend Adjusted? 41 Are the Data Survivorship-Bias Free? 44 Does Your Strategy Use High and Low Data? 46 Performance Measurement 47 Common Backtesting Pitfalls to Avoid 57 Look-Ahead Bias 58 Data-Snooping Bias 59 Transaction Costs 72 Strategy Refinement 77 Summary 78 References 79 Chapter 4: Setting Up Your Business 81 Business Structure: Retail or Proprietary? 81 Choosing a Brokerage or Proprietary Trading Firm 85 Physical Infrastructure 87 Summary 89 References 91 Chapter 5: Execution Systems 93 What an Automated Trading System Can Do for You 93 Building a Semiautomated Trading System 95 Building a Fully Automated Trading System 98 Minimizing Transaction Costs 101 Testing Your System by Paper Trading 103 Why Does Actual Performance Diverge from Expectations? 104 Summary 107 Chapter 6: Money and Risk Management 109 Optimal Capital Allocation and Leverage 109 Risk Management 120 Model Risk 124 Software Risk 125 Natural Disaster Risk 125 Psychological Preparedness 125 Summary 130 Appendix: A Simple Derivation of the Kelly Formula when Return Distribution Is Gaussian 131 References 132 Chapter 7: Special Topics in Quantitative Trading 133 Mean-Reverting versus Momentum Strategies 134 Regime Change and Conditional Parameter Optimization 137 Stationarity and Cointegration 147 Factor Models 160 What Is Your Exit Strategy? 169 Seasonal Trading Strategies 174 High-Frequency Trading Strategies 186 Is it Better to Have a High-Leverage versus a High-Beta Portfolio? 188 Summary 190 References 192 Chapter 8: Conclusion 193 Next Steps 197 References 198 Appendix: A Quick Survey of MATLAB 199 Bibliography 205 About the Author 209 Index 211

Synopsis

Master the lucrative discipline of quantitative trading with this insightful handbook from a master in the field In the newly revised Second Edition of Quantitative Trading: How to Build Your Own Algorithmic Trading Business , quant trading expert Dr. Ernest P. Chan shows you how to apply both time-tested and novel quantitative trading strategies to develop or improve your own trading firm. You'll discover new case studies and updated information on the application of cutting-edge machine learning investment techniques, as well as: Updated back tests on a variety of trading strategies, with included Python and R code examples A new technique on optimizing parameters with changing market regimes using machine learning. A guide to selecting the best traders and advisors to manage your money Perfect for independent retail traders seeking to start their own quantitative trading business, or investors looking to invest in such traders, this new edition of Quantitative Trading will also earn a place in the libraries of individual investors interested in exploring a career at a major financial institution.

LC Classification Number

HG4529.C445 2021

Item description from the seller

Seller feedback (132)

- eBay automated Feedback- Feedback left by buyer.Past monthOrder delivered on time with no issues

- eBay automated Feedback- Feedback left by buyer.Past monthOrder delivered on time with no issues

- eBay automated Feedback- Feedback left by buyer.Past monthOrder delivered on time with no issues

More to explore :

- Choose Your Own Adventure,

- Choose Your Own Adventure Fiction Paperbacks Books in English,

- Choose Your Own Adventure Action Fiction Fiction & Nonfiction Books,

- Choose Your Own Adventure Fiction Hardcover Books,

- Choose Your Own Adventure Fiction Illustrated Paperbacks Books,

- Choose Your Own Adventure Fiction & Ages 4-8 Intended Audience Fiction Books,

- Trade Paperbacks,

- Trade Paperbacks Books,

- Trade Study Guides & Test Prep,

- Trade Paperbacks Books in English