Picture 1 of 8

Gallery

Picture 1 of 8

Have one to sell?

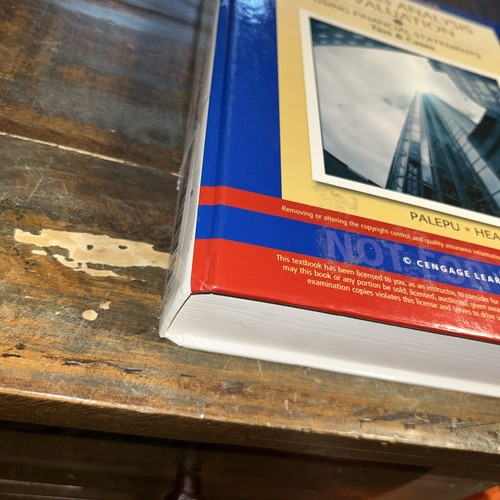

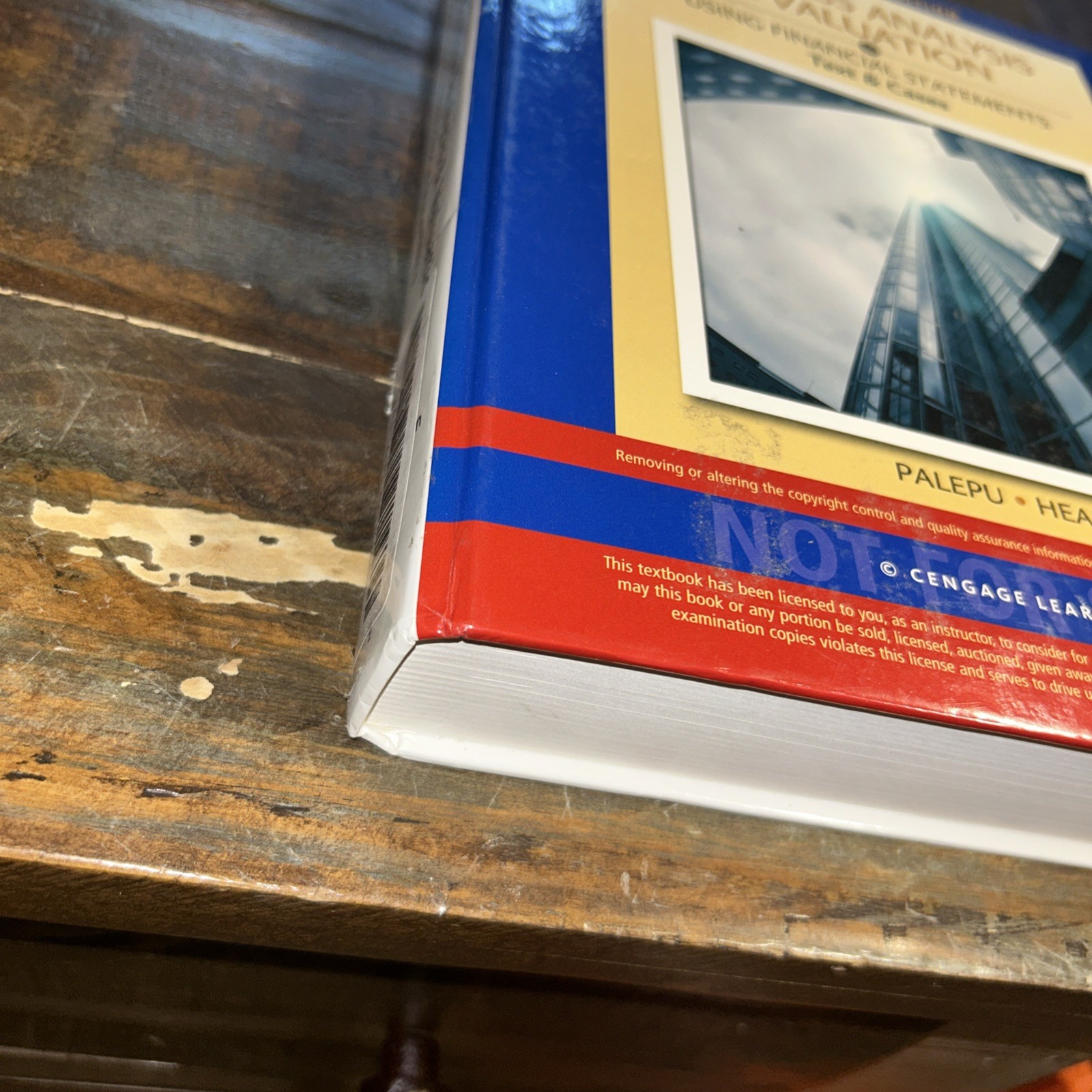

Instructors edit Business Analysis and Valuation: - Hardcover, by Palepu Krishna

US $49.00

ApproximatelyRM 206.11

Condition:

Very Good

A book that has been read but is in excellent condition. No obvious damage to the cover, with the dust jacket included for hard covers. No missing or damaged pages, no creases or tears, and no underlining/highlighting of text or writing in the margins. May be very minimal identifying marks on the inside cover. Very minimal wear and tear.

Oops! Looks like we're having trouble connecting to our server.

Refresh your browser window to try again.

Shipping:

Free USPS Media MailTM.

Located in: Alma, Arkansas, United States

Delivery:

Estimated between Mon, 18 Aug and Sat, 23 Aug to 94104

Returns:

14 days return. Buyer pays for return shipping. If you use an eBay shipping label, it will be deducted from your refund amount.

Coverage:

Read item description or contact seller for details. See all detailsSee all details on coverage

(Not eligible for eBay purchase protection programmes)

Seller assumes all responsibility for this listing.

eBay item number:406104893885

Item specifics

- Condition

- Book Title

- Business Analysis and Valuation: Using Financial Statements, Text

- ISBN

- 9781111972288

About this product

Product Identifiers

Publisher

Cengage South-Western

ISBN-10

1111972281

ISBN-13

9781111972288

eBay Product ID (ePID)

111431288

Product Key Features

Number of Pages

960 Pages

Language

English

Publication Name

Business Analysis and Valuation : Using Financial Statements, Text and Cases (with Thomson Analytics Printed Access Card)

Subject

Accounting / Financial, Finance / General, Corporate Finance / Valuation

Publication Year

2012

Features

Revised

Type

Textbook

Subject Area

Business & Economics

Format

Hardcover

Dimensions

Item Height

1.7 in

Item Weight

66.5 Oz

Item Length

9.5 in

Item Width

8.2 in

Additional Product Features

Edition Number

5

Intended Audience

College Audience

Table Of Content

I. FRAMEWORK. 1. A Framework for Business Analysis and Valuation Using Financial Statements. Case: New Century Financial. II: BUSINESS ANALYSIS AND VALUATION TOOLS. 2. Strategy Analysis. Case: Visio, Inc. 3. Overview of Accounting Analysis. Case: The Fall of Enron. 4. Implementing Accounting Analysis. Case: Accounting for the iPhone at Apple, Inc. 5. Financial Analysis. Case: United Parcel Service's IPS. 6. Prospective Analysis: Forecasting. Case: Krispy Kreme Doughnuts. 7. Prospective Analysis: Valuation Theory and Concepts. Case: Valuation Ratios in the Restaurant Industry. 8. Prospective Analysis: Valuation Implementation. Case: Home Depot, Inc., in the New Millennium. III. BUSINESS ANALYSIS AND VALUATION APPLICATIONS. 9. Equity Security Analysis. Case: Oddo Securities: ESG Integration. 10. Credit Analysis and Distress Prediction. Case: Liz Claiborne. 11. Mergers and Acquisitions. Case: Eddie Bauer (A). 12. Communication and Governance. Case: Target Corporation: Ackman versus the Board. IV. ADDITIONAL CASES. The Role of Capital Market Intermediaries in the Dot-Com Crash of 2000. Harnischfeger Corporation. Revenue Recognition Problems in the Communications Equipment Industry. Amazon.com in the Year 2000. Schneider and Square D. Financial Reporting Problems at Molex, Inc. (A). America Online, Inc. Boston Chicken, Inc. Hewlett-Packard-Compaq: The Merger Decision. The Home Depot, Inc. Pre-Paid Legal Services, Inc. Subprime Crisis and Fair Value Accounting. Leasing Decision at Magnet Beauty Products, Inc. The Risk Reward Framework at Morgan Stanley Research. Sidoti & Company: Launching a Micro-Cap Product. Corruption at Siemens (A).

Edition Description

Revised edition

Synopsis

Financial statements are the basis for a wide range of business analysis. Managers, securities analysts, bankers, and consultants all use them to make business decisions. There is strong demand among business students for course materials that provide a framework for using financial statement data in a variety of business analysis and valuation contexts. BUSINESS ANALYSIS & VALUATION: USING FINANCIAL STATEMENTS, TEXT & CASES, 5E allows you to undertake financial statement analysis using a four-part framework(1) business strategy analysis for developing an understanding of a firm's competitive strategy; (2) accounting analysis for representing the firm's business economics and strategy in its financial statements, and for developing adjusted accounting measures of performance; (3) financial analysis for ratio analysis and cash flow measures of operating; and (4) prospective analysis. Then, you'll learn how to apply these tools in a variety of decision contexts, including securities analysis, credit analysis, corporate financing policies analysis, mergers and acquisitions analysis, and governance and communication analysis. This text also offers one Harvard case per chapter as well as an entirely separate section (Section 4) for additional cases!, Financial statements are the basis for a wide range of business analysis. Managers, securities analysts, bankers, and consultants all use them to make business decisions. There is strong demand among business students for course materials that provide a framework for using financial statement data in a variety of business analysis and valuation contexts. BUSINESS ANALYSIS & VALUATION: USING FINANCIAL STATEMENTS, TEXT & CASES, 5E allows you to undertake financial statement analysis using a four-part framework--(1) business strategy analysis for developing an understanding of a firm's competitive strategy; (2) accounting analysis for representing the firm's business economics and strategy in its financial statements, and for developing adjusted accounting measures of performance; (3) financial analysis for ratio analysis and cash flow measures of operating; and (4) prospective analysis. Then, you'll learn how to apply these tools in a variety of decision contexts, including securities analysis, credit analysis, corporate financing policies analysis, mergers and acquisitions analysis, and governance and communication analysis.This text also offers one Harvard case per chapter as well as an entirely separate section (Section 4) for additional cases!, Financial statements are the basis for a wide range of business analysis. Managers, securities analysts, bankers, and consultants all use them to make business decisions. There is strong demand among business students for course materials that provide a framework for using financial statement data in a variety of business analysis and valuation contexts. BUSINESS ANALYSIS & VALUATION: USING FINANCIAL STATEMENTS, TEXT & CASES, 5E allows you to undertake financial statement analysis using a four-part framework(1) business strategy analysis for developing an understanding of a firm's competitive strategy; (2) accounting analysis for representing the firm's business economics and strategy in its financial statements, and for developing adjusted accounting measures of performance; (3) financial analysis for ratio analysis and cash flow measures of operating; and (4) prospective analysis. Then, you'll learn how to apply these tools in a variety of decision contexts, including securities analysis, credit analysis, corporate financing policies analysis, mergers and acquisitions analysis, and governance and communication analysis. This text also offers one Harvard case per chapter as well as an entirely separate section (Section 4) for additional cases

Item description from the seller

Seller feedback (1,258)

- l***a (451)- Feedback left by buyer.Past monthVerified purchaseA+++ Seller. Got here quickly in great condition. Thanks so much

- g***s (476)- Feedback left by buyer.Past monthVerified purchaseawesome, as described

- 5***e (169)- Feedback left by buyer.Past monthVerified purchaseNew as described Fast shipping

More to explore :

- Limited Edition Business Hardcover Antiquarian & Collectible Books,

- 1st Edition Business Hardcover Antiquarian & Collectible Books,

- Business, Economics & Industry Nonfiction Books Hardcover International Edition,

- Teacher's Edition Hardcover Textbooks,

- Hardcovers Books with Special Edition,

- International Edition Hardcover Textbooks,

- Illustrated Business Hardcover Antiquarian & Collectible Books,

- Business Reference Hardcover Antiquarian & Collectible Books,

- Luxury Edition Hardcover Antiquarian & Collectible Books,

- Hardcover Book Club Edition Books