Picture 1 of 24

Gallery

Picture 1 of 24

Have one to sell?

Arbitrage Theory in Continuous Time (Oxford Finance Series) by

US $39.55

ApproximatelyRM 167.18

Condition:

Like New

A book in excellent condition. Cover is shiny and undamaged, and the dust jacket is included for hard covers. No missing or damaged pages, no creases or tears, and no underlining/highlighting of text or writing in the margins. May be very minimal identifying marks on the inside cover. Very minimal wear and tear.

Oops! Looks like we're having trouble connecting to our server.

Refresh your browser window to try again.

Pickup:

Free local pickup from Van Nuys, California, United States.

Shipping:

US $5.22 (approx RM 22.06) USPS Media MailTM.

Located in: Van Nuys, California, United States

Delivery:

Estimated between Tue, 26 Aug and Fri, 29 Aug to 94104

Returns:

30 days return. Seller pays for return shipping.

Coverage:

Read item description or contact seller for details. See all detailsSee all details on coverage

(Not eligible for eBay purchase protection programmes)

Seller assumes all responsibility for this listing.

eBay item number:396358902303

Item specifics

- Condition

- Book Title

- Arbitrage Theory in Continuous Time (Oxford Finance Series)

- ISBN

- 9780198851615

About this product

Product Identifiers

Publisher

Oxford University Press, Incorporated

ISBN-10

0198851618

ISBN-13

9780198851615

eBay Product ID (ePID)

17038266592

Product Key Features

Number of Pages

592 Pages

Language

English

Publication Name

Arbitrage Theory in Continuous Time

Publication Year

2020

Subject

Finance / General, Economics / General

Type

Textbook

Subject Area

Business & Economics

Series

Oxford Finance Ser.

Format

Hardcover

Dimensions

Item Height

1.4 in

Item Weight

35.3 Oz

Item Length

9.2 in

Item Width

6 in

Additional Product Features

Edition Number

4

Intended Audience

Scholarly & Professional

LCCN

2019-949441

Dewey Edition

22

Reviews

Review from previous edition This book is one of the best of a large number of new books on mathematical and probabilistic models in finance, positioned between the books by Hull and Duffie on a mathematical scale...This is a highly reasonable book and strikes a balance between mathematical development and intuitive explanation.

Illustrated

Yes

Dewey Decimal

332.64/5

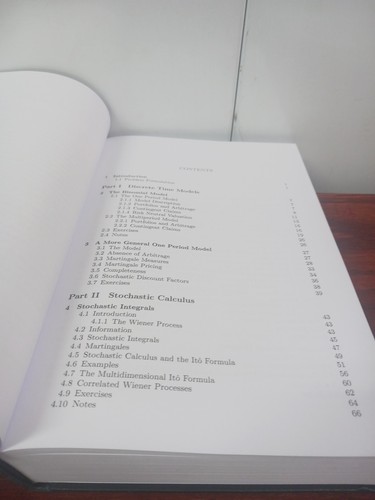

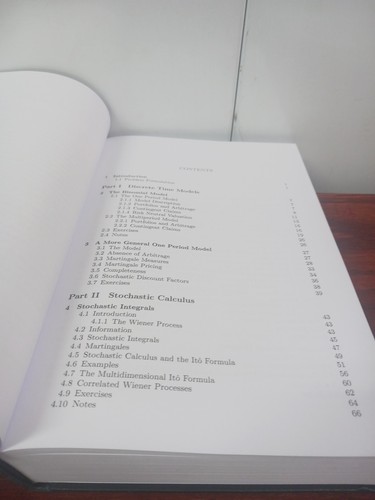

Table Of Content

1. IntroductionI. Discrete Time Models2. The Binomial Model3. A More General One period ModelII. Stochastic Calculus4. Stochastic Integrals5. Stochastic Differential EquationsIII. Arbitrage Theory6. Portfolio Dynamics7. Arbitrage Pricing8. Completeness and Hedging9. A Primer on Incomplete Markets10. Parity Relations and Delta Hedging11. The Martingale Approach to Arbitrage Theory12. The Mathematics of the Martingale Approach13. Black-Scholes from a Martingale Point of View14. Multidimensional Models: Martingale Approach15. Change of Numeraire16. Dividends17. Forward and Futures Contracts18. Currency Derivatives19. Bonds and Interest Rates20. Short Rate Models21. Martingale Models for the Short Rate22. Forward Rate Models23. LIBOR Market Models24. Potentials and Positive InterestIV. Optimal Control and Investment Theory25. Stochastic Optimal Control26. Optimal Consumption and Investment27. The Martingale Approach to Optimal Investment28. Optimal Stopping Theory and American OptionsV. Incomplete Markets29. Incomplete Markets30. The Esscher Transform and the Minimal Martingale Measure31. Minimizing f-divergence32. Portfolio Optimization in Incomplete Markets33. Utility Indifference Pricing and Other Topics34. Good Deal BoundsVI. Dynamic Equilibrium Theory35. Equilibrium Theory: A Simple Production Model36. The Cox-Ingersoll-Ross Factor Model37. The Cox-Ingersoll-Ross Interest Rate Model38. Endowment Equilibrium: Unit Net Supply

Synopsis

The fourth edition of this widely used textbook on pricing and hedging of financial derivatives now also includes dynamic equilibrium theory and continues to combine sound mathematical principles with economic applications. Concentrating on the probabilistic theory of continuous time arbitrage pricing of financial derivatives, including stochastic optimal control theory and optimal stopping theory, Arbitrage Theory in Continuous Time is designed for graduate students in economics and mathematics, and combines the necessary mathematical background with a solid economic focus. It includes a solved example for every new technique presented, contains numerous exercises, and suggests further reading in each chapter. All concepts and ideas are discussed, not only from a mathematics point of view, but with lots of intuitive economic arguments.In the substantially extended fourth edition Tomas Björk has added completely new chapters on incomplete markets, treating such topics as the Esscher transform, the minimal martingale measure, f-divergences, optimal investment theory for incomplete markets, and good deal bounds. This edition includes an entirely new section presenting dynamic equilibrium theory, covering unit net supply endowments models and the Cox-Ingersoll-Ross equilibrium factor model. Providing two full treatments of arbitrage theory-the classical delta hedging approach and the modern martingale approach-this book is written so that these approaches can be studied independently of each other, thus providing the less mathematically-oriented reader with a self-contained introduction to arbitrage theory and equilibrium theory, while at the same time allowing the more advanced student to see the full theory in action. This textbook is a natural choice for graduate students and advanced undergraduates studying finance and an invaluable introduction to mathematical finance for mathematicians and professionals in the market., The fourth edition of this widely used textbook on pricing and hedging of financial derivatives now also includes dynamic equilibrium theory and continues to combine sound mathematical principles with economic applications. Concentrating on the probabilistic theory of continuous time arbitrage pricing of financial derivatives, including stochastic optimal control theory and optimal stopping theory, Arbitrage Theory in Continuous Time is designed for graduate students in economics and mathematics, and combines the necessary mathematical background with a solid economic focus. It includes a solved example for every new technique presented, contains numerous exercises, and suggests further reading in each chapter. All concepts and ideas are discussed, not only from a mathematics point of view, but with lots of intuitive economic arguments. In the substantially extended fourth edition Tomas Bjork has added completely new chapters on incomplete markets, treating such topics as the Esscher transform, the minimal martingale measure, f-divergences, optimal investment theory for incomplete markets, and good deal bounds. This edition includes an entirely new section presenting dynamic equilibrium theory, covering unit net supply endowments models and the Cox-Ingersoll-Ross equilibrium factor model. Providing two full treatments of arbitrage theory-the classical delta hedging approach and the modern martingale approach-this book is written so that these approaches can be studied independently of each other, thus providing the less mathematically-oriented reader with a self-contained introduction to arbitrage theory and equilibrium theory, while at the same time allowing the more advanced student to see the full theory in action. This textbook is a natural choice for graduate students and advanced undergraduates studying finance and an invaluable introduction to mathematical finance for mathematicians and professionals in the market., The fourth edition of this widely used textbook on pricing and hedging of financial derivatives now also includes dynamic equilibrium theory and continues to combine sound mathematical principles with economic applications. Concentrating on the probabilistic theory of continuous time arbitrage pricing of financial derivatives, including stochastic optimal control theory and optimal stopping theory, Arbitrage Theory in Continuous Time is designed for graduate students in economics and mathematics, and combines the necessary mathematical background with a solid economic focus. It includes a solved example for every new technique presented, contains numerous exercises, and suggests further reading in each chapter. All concepts and ideas are discussed, not only from a mathematics point of view, but with lots of intuitive economic arguments.In the substantially extended fourth edition Tomas Björk has added completely new chapters on incomplete markets, treating such topics as the Esscher transform, the minimal martingale measure, f-divergences, optimal investment theory for incomplete markets, and good deal bounds. This edition includes an entirely new section presenting dynamic equilibrium theory, covering unit net supply endowments models and the Cox-Ingersoll-Ross equilibrium factor model. Providing two full treatments of arbitrage theory - the classical delta hedging approach and the modern martingale approach - this book is written so that these approaches can be studied independently of each other, thus providing the less mathematically-oriented reader with a self-contained introduction to arbitrage theory and equilibrium theory, while at the same time allowing the more advanced student to see the full theory in action. This textbook is a natural choice for graduate students and advanced undergraduates studying finance and an invaluable introduction to mathematical finance for mathematicians and professionals in the market., The fourth edition of this widely used textbook on pricing and hedging of financial derivatives now also includes dynamic equilibrium theory and continues to combine sound mathematical principles with economic applications.

LC Classification Number

HG6024.A3B567 2020

Item description from the seller

Seller feedback (598)

- b***2 (5037)- Feedback left by buyer.Past monthVerified purchaseReally amazing book. Arrived quick and packed well. Please shop here you'll be so very much happy like me .10/10⭐

- y***f (1194)- Feedback left by buyer.Past monthVerified purchaseI received the "Fabric of a Nation: American Quilt Stories" Book today and it's in EUC-looks 'Brand New' and unread, the pages are clean and crisp and unmarked inside/out. It has great photographs/historical information and quality looking designs. It shipped fast and arrived securely packed in plastic with extra bubble-wrap, thanks so much.

- m***0 (337)- Feedback left by buyer.Past monthVerified purchasegreat seller,A+++, thanks