Picture 1 of 7

Gallery

Picture 1 of 7

Have one to sell?

Semi-Markov Models and Applications by Jacques Janssen Nikolaos Limnios

US $50.00

ApproximatelyRM 211.29

or Best Offer

Condition:

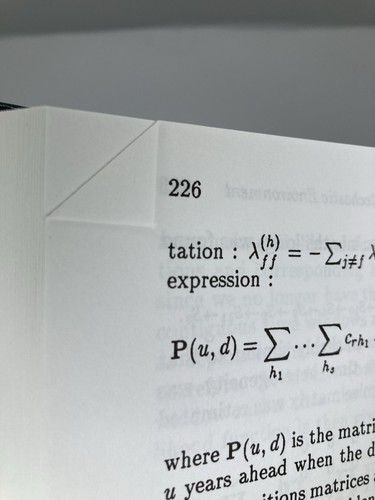

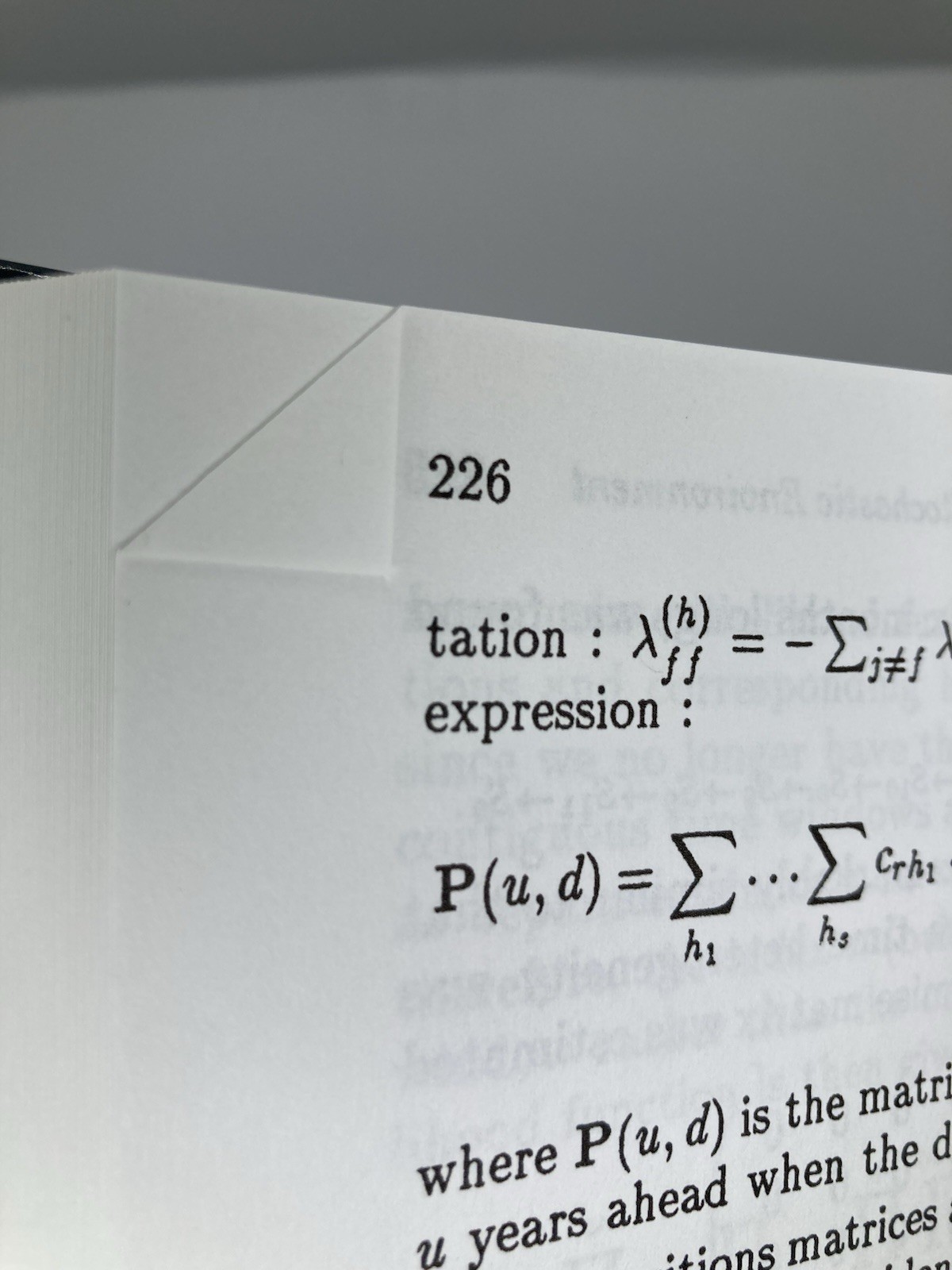

“Book is in excellent shape, with some minor dents and dog ears on some of the page corners. Overall ”... Read moreabout condition

Oops! Looks like we're having trouble connecting to our server.

Refresh your browser window to try again.

Pickup:

Free local pickup from Davis, California, United States.

Shipping:

US $5.97 (approx RM 25.23) USPS Media MailTM.

Located in: Davis, California, United States

Delivery:

Estimated between Fri, 24 Oct and Wed, 29 Oct to 94104

Returns:

No returns accepted.

Coverage:

Read item description or contact seller for details. See all detailsSee all details on coverage

(Not eligible for eBay purchase protection programmes)

Seller assumes all responsibility for this listing.

eBay item number:205708638775

All net proceeds will support Yolo County SPCA

- Official eBay for Charity listing. Learn more

- This sale benefits a verified non-profit partner.

Item specifics

- Condition

- Very Good

- Seller Notes

- Book Title

- Semi-Markov Models and Applications

- ISBN

- 9780792359630

About this product

Product Identifiers

Publisher

Springer

ISBN-10

0792359631

ISBN-13

9780792359630

eBay Product ID (ePID)

1653791

Product Key Features

Number of Pages

Xxii, 404 Pages

Publication Name

Semi-Markov Models and Applications

Language

English

Publication Year

1999

Subject

General, Number Theory, Logic

Type

Textbook

Subject Area

Mathematics

Format

Hardcover

Dimensions

Item Weight

60.7 Oz

Item Length

9.3 in

Item Width

6.1 in

Additional Product Features

Intended Audience

Scholarly & Professional

LCCN

99-044178

Dewey Edition

21

Number of Volumes

1 vol.

Illustrated

Yes

Dewey Decimal

519.2/33

Table Of Content

I Extensions of Basic Models.- 1 The Solidarity of Markov Renewal Processes.- 2 A Generalization of Semi-Markov Processes.- 3 Quasi-stationary Phenomena for Semi-Markov Processes.- 4 Semi-Markov Random Walks.- 5 Diffusion Approximation for Processes with Semi-Markov Switches.- 6 Approximations for Semi-Markov Single Ion Channel Models.- II Statistical Estimation.- 7 Log-likelihood in Stochastic Processes.- 8 Some Asymptotic Results and Exponential Approximation in Semi-Markov Models.- 9 Markov Renewal Processes and Exponential Families.- 10 On Homogeneity of Two Semi-Markov Samples.- 11 Product-Type Estimator of Convolutions.- 12 Failure Rate Estimation of Semi-Markov Systems.- 13 Estimation for Semi-Markov Manpower Models in a Stochastic Environment.- 14 Semi-Markov Models for Lifetime Data Analysis.- III Non-Homogeneous Models.- 15 Continuous Time Non Homogeneous Semi-Markov Systems.- 16 The Perturbed Non-Homogeneous Semi-Markov System.- IV Queueing Systems Theory.- 17 Semi-Markov Queues with Heavy Tails.- 18 MR Modelling of Poisson Traffic at Intersections Having Separate Turn Lanes.- V Financial Models.- 19 Stochastic Stability and Optimal Control in Insurance Mathematics.- 20 Option Pricing with Semi-Markov Volatility.- VI Controlled Processes & Maintenance.- 21 Applications of Semi-Markov Processes in Reliability and Maintenance.- 22 Controlled Queueing Systems with Recovery Functions.- VII Chromatography & Fluid Mechanics.- 23 Continuous Semi-Markov Models for Chromatography.- 24 The Stress Tensor of the Closed Semi-Markov System. Energy and Entropy.

Synopsis

This book presents a selection of papers presented to the Second Inter national Symposium on Semi-Markov Models: Theory and Applications held in Compiegne (France) in December 1998. This international meeting had the same aim as the first one held in Brussels in 1984 : to make, fourteen years later, the state of the art in the field of semi-Markov processes and their applications, bring together researchers in this field and also to stimulate fruitful discussions. The set of the subjects of the papers presented in Compiegne has a lot of similarities with the preceding Symposium; this shows that the main fields of semi-Markov processes are now well established particularly for basic applications in Reliability and Maintenance, Biomedicine, Queue ing, Control processes and production. A growing field is the one of insurance and finance but this is not really a surprising fact as the problem of pricing derivative products represents now a crucial problem in economics and finance. For example, stochastic models can be applied to financial and insur ance models as we have to evaluate the uncertainty of the future market behavior in order, firstly, to propose different measures for important risks such as the interest risk, the risk of default or the risk of catas trophe and secondly, to describe how to act in order to optimize the situation in time. Recently, the concept of VaR (Value at Risk) was "discovered" in portfolio theory enlarging so the fundamental model of Markowitz., This book presents a selection of papers presented to the Second Inter- national Symposium on Semi-Markov Models: Theory and Applications held in Compiegne (France) in December 1998. This international meeting had the same aim as the first one held in Brussels in 1984: to make, fourteen years later, the state of the art in the field of semi-Markov processes and their applications, bring together researchers in this field and also to stimulate fruitful discussions. The set of the subjects of the papers presented in Compiegne has a lot of similarities with the preceding Symposium; this shows that the main fields of semi-Markov processes are now well established particularly for basic applications in Reliability and Maintenance, Biomedicine, Queue- ing, Control processes and production. A growing field is the one of insurance and finance but this is not really a surprising fact as the problem of pricing derivative products represents now a crucial problem in economics and finance. For example, stochastic models can be applied to financial and insur- ance models as we have to evaluate the uncertainty of the future market behavior in order, firstly, to propose different measures for important risks such as the interest risk, the risk of default or the risk of catas- trophe and secondly, to describe how to act in order to optimize the situation in time. Recently, the concept of VaR (Value at Risk) was "discovered" in portfolio theory enlarging so the fundamental model of Markowitz.

LC Classification Number

QA1-939

Item description from the seller

Seller feedback (8,641)

- m***m (736)- Feedback left by buyer.Past monthVerified purchaseExcellent communication, as described, extremely fast well packed shipping. And benefits a good cause! Thank you.

- 6***z (168)- Feedback left by buyer.Past monthVerified purchaseAs described, such a beautiful necklace, well packed and fast shipping. Great Seller.

- t***d (373)- Feedback left by buyer.Past monthVerified purchaseBeautiful jade bangle, just as pictured. It was packaged nicely and shipped fast. Great seller. Recommend.

More to explore :

- Life Application Study Bible Niv,

- Life Application Study Bible Books,

- Fiction Books & Brian Jacques Fiction,

- Brian Jacques Hardcover Illustrated Fiction Books,

- Brian Jacques Fantasy Fiction Fiction & Books,

- Brian Jacques Fantasy Fiction Hardcovers Books,

- Models Magazines,

- Model Railroader Magazines,

- Finescale Modeler Magazines,

- Model Railroader Trains Magazines