Picture 1 of 6

Gallery

Picture 1 of 6

Have one to sell?

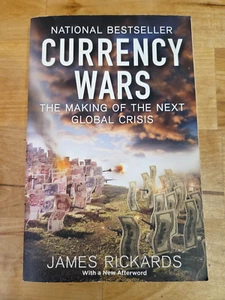

Currency Wars: The Making of the Next Global Crisis by James Rickards-Paper

US $2.75

ApproximatelyRM 11.77

or Best Offer

Condition:

“There is minimal wear to the covers and binding. The pages have no marks/writing.”

Very Good

A book that has been read but is in excellent condition. No obvious damage to the cover, with the dust jacket included for hard covers. No missing or damaged pages, no creases or tears, and no underlining/highlighting of text or writing in the margins. May be very minimal identifying marks on the inside cover. Very minimal wear and tear.

Oops! Looks like we're having trouble connecting to our server.

Refresh your browser window to try again.

Pickup:

Free local pickup from Pierce, Colorado, United States.

Shipping:

US $4.47 (approx RM 19.12) USPS Media MailTM.

Located in: Pierce, Colorado, United States

Delivery:

Estimated between Thu, 7 Aug and Mon, 11 Aug to 94104

Returns:

30 days return. Seller pays for return shipping.

Coverage:

Read item description or contact seller for details. See all detailsSee all details on coverage

(Not eligible for eBay purchase protection programmes)

Seller assumes all responsibility for this listing.

eBay item number:135562793339

Item specifics

- Condition

- Very Good

- Seller Notes

- “There is minimal wear to the covers and binding. The pages have no marks/writing.”

- Personalize

- No

- Type

- Paperback

- Signed

- No

- Ex Libris

- No

- Narrative Type

- Nonfiction

- Personalized

- No

- Original Language

- English

- Country/Region of Manufacture

- United States

- Intended Audience

- Adults

- Inscribed

- No

- Vintage

- No

- ISBN

- 9781591845560

About this product

Product Identifiers

Publisher

Penguin Publishing Group

ISBN-10

1591845564

ISBN-13

9781591845560

eBay Product ID (ePID)

117289843

Product Key Features

Book Title

Currency Wars : the Making of the Next Global Crisis

Number of Pages

300 Pages

Language

English

Topic

Foreign Exchange, Economic History, Economic Conditions, Forecasting, Money & Monetary Policy

Publication Year

2012

Illustrator

Yes

Genre

Business & Economics

Format

Trade Paperback

Dimensions

Item Height

0.8 in

Item Weight

9.7 Oz

Item Length

8.3 in

Item Width

5.5 in

Additional Product Features

Intended Audience

Trade

Dewey Edition

23

Reviews

"One of the scariest books I've read this year. The picture that emerges is dark yet comprehensive and satisfying." -- Bloomberg Businessweek "One of the most urgent books of the fall." -- Mike Allen, Politico "Let's hope he's wrong." -- Financial Times "Unsettling...fascinating...a thorough analysis of how nations have manipulated their currencies...with disastrous consequences." -- Fort Worth Star-Telegram, "One of the scariest books I've read this year. The picture that emerges is dark yet comprehensive and satisfying." -- Bloomberg Businessweek "One of the most urgent books of the fall." -- Mike Allen, Politico "Let's hope he's wrong." -- Financial Times "Unsettling...fascinating...a thorough analysis of how nations have manipulated their currencies...with disastrous consequences." -- Fort Worth Star-Telegram

Grade From

Twelfth Grade

Dewey Decimal

332.4

Synopsis

In 1971, President Nixon imposed national price controls and took the United States off the gold standard, an extreme measure intended to end an ongoing currency war that had destroyed faith in the U.S. dollar. Today we are engaged in a new currency war, and this time the consequences will be far worse than those that confronted Nixon. Currency wars are one of the most destructive and feared outcomes in international economics. At best, they offer the sorry spectacle of countries' stealing growth from their trading partners. At worst, they degenerate into sequential bouts of inflation, recession, retaliation, and sometimes actual violence. Left unchecked, the next currency war could lead to a crisis worse than the panic of 2008. Currency wars have happened before-twice in the last century alone-and they always end badly. Time and again, paper currencies have collapsed, assets have been frozen, gold has been confiscated, and capital controls have been imposed. And the next crash is overdue. Recent headlines about the debasement of the dollar, bailouts in Greece and Ireland, and Chinese currency manipulation are all indicators of the growing conflict. As James Rickards argues in Currency Wars , this is more than just a concern for economists and investors. The United States is facing serious threats to its national security, from clandestine gold purchases by China to the hidden agendas of sovereign wealth funds. Greater than any single threat is the very real danger of the collapse of the dollar itself. Baffling to many observers is the rank failure of economists to foresee or prevent the economic catastrophes of recent years. Not only have their theories failed to prevent calamity, they are making the currency wars worse. The U. S. Federal Reserve has engaged in the greatest gamble in the history of finance, a sustained effort to stimulate the economy by printing money on a trillion-dollar scale. Its solutions present hidden new dangers while resolving none of the current dilemmas. While the outcome of the new currency war is not yet certain, some version of the worst-case scenario is almost inevitable if U.S. and world economic leaders fail to learn from the mistakes of their predecessors. Rickards untangles the web of failed paradigms, wishful thinking, and arrogance driving current public policy and points the way toward a more informed and effective course of action., Dive into the gripping world of international ecocomics through American lawyer, investment banker, media commentator, and author, James G. Rickards's expertise and thought-provoking insights. From collapsed paper currencies and hidden agendas of soveriegn wealth funds to the very real threats of national security, James G. Rickards scrutinizes the history and disastrous outcomes of currency wars, shedding light on the potential crisis that looms over the United States and the world. Rickards dissects failed paradigms and conventional theories while offering a course of action to steer away from impending disaster., Currency wars are one of the most destructive and feared outcomes in international economics. At best, they offer the sorry spectacle of countries stealing growth from their trading partners. At worst, they degenerate into sequential bouts of inflation, recession, retaliation and sometimes actual violence. Left unchecked the next currency war could lead to a crisis worse than the panic of 2008.The next crash is overdue. Recent headlines about the Eurozone crisis, the bailouts for Greece, riots caused by austerity measures as well as the debasement of the dollar.

LC Classification Number

HG3851.3.R53 2012

Item description from the seller

Seller feedback (1,956)

- -***-- Feedback left by buyer.Past monthVerified purchase🌟🌟🌟🌟🌟

- w***1 (2293)- Feedback left by buyer.Past monthVerified purchaseA pleasant problem free transaction. Thanks

- h***c (6)- Feedback left by buyer.Past monthVerified purchaseGreat condition, thanks!

More to explore :

- War Fiction Paperbacks Books,

- James Michener Paperbacks Books,

- Wars Paperback Textbooks,

- Globalization Paperback Textbooks,

- James Patterson Paperbacks Books,

- War Nonfiction Paperbacks Books,

- James Patterson Fiction Paperbacks Books,

- James Joyce Fiction Paperbacks Books,

- Timothy Zahn Star Wars Fiction Paperbacks Books,

- Henry James Paperbacks Books in English